8 of the Best FREE Budgeting Apps to Make The Most Of Your Money

We’ve rounded up the best budgeting apps to help you take control of your finances — all available for free!

How do YOU budget?

Whether you’re trying to get your finances in check or are joining accounts with your partner, we’ve rounded up the best free budgeting apps on the market.

We’d all like to be a little bit better with our money, right? But between the holidays, summer vacations, and unexpected expenses, that goal can start to slip out of reach. Here are some awesome apps available to help you take control of your financial wellness… and the best part? They’re FREE or offer a free version of their app!

1. Honeydue is great for couples

Honeydue allows you and your partner to keep on track of your finances together. You can link all your bank accounts in one place and interact with each other’s transactions. Honeydue is compatible with over 2,000 banks in five countries!

One of the best assets of this app is it will remind you when it’s time to pay upcoming bills, plus twenty categories to assign your spending to a specific budget. It will also keep your financial security intact!

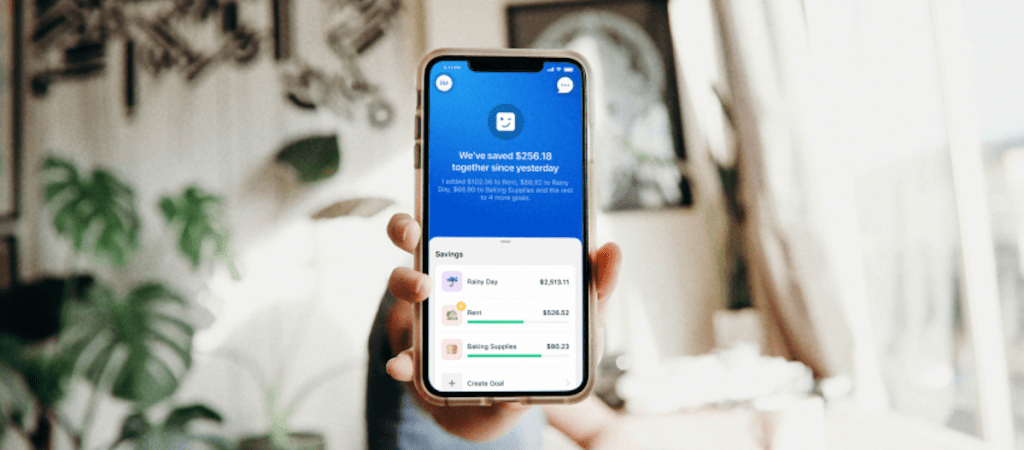

2. For those looking to save more money, try Digit.

This is the easiest setup of all the apps mentioned in this post. After logging in, you connect your checking account… and that’s it! You can set your own goals, but you’re given a “Rainy Day” account by default – and in my opinion, one general account is really all you need. After analyzing your income and spending habits, the app secretly transfers bits of money from your checking account to your Digit account.

While I like the “out of sight, out of mind” mentality of this app, I was slightly worried at first about how these savings transfers would affect my bank account. Thankfully, Digit has a policy of unlimited withdrawals and a no-overdraft guarantee, making this app perfect for anyone looking to save money without having to think about it.

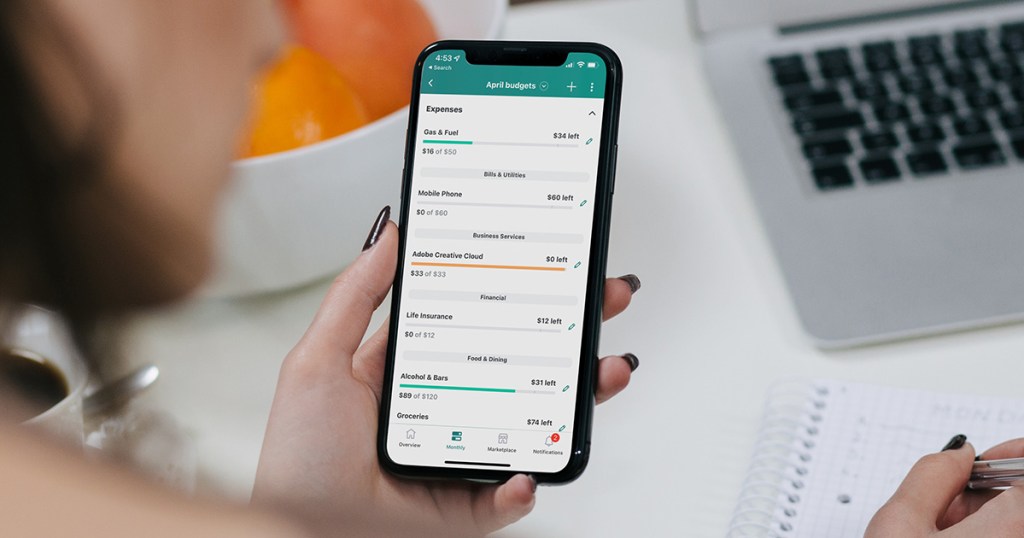

3. Mint is super user-friendly and engaging.

Mint is my Hip sidekick Emily’s budgeting app of choice, and she’s been using it for around 9 years now! With Mint, just sync all of your financial accounts in the app (whether they’re checking accounts, credit cards, mortgages, auto loans, investments, etc.), and Mint streamlines them in one visible space.

You can create budgets, set goals, monitor spending, view transactions, check on your credit score, and review vital spending information in easy-to-use breakdowns and charts. You’ll even have suggestions made to you from the app, like savings account and credit card recommendations or budget categories to consider setting up.

Hip Tip: With SO much information available at a glance, access account overviews on the website instead of your tiny mobile screen for a clear view of everything.

4. GoodBudget is perfect for the classic “virtual” envelope system.

Website | iOS | Android

FREE | GoodBudget Plus option for $5.99/month to add more envelopes and budgets

What’s so good about GoodBudget is that it’s a virtual envelope system, and it doesn’t require you to actually sync up your financial accounts. Having a digital envelope system is great for people who tend to make more purchases with credit cards rather than cash.

You simply open the app, create your envelopes (some example envelopes are pre-installed), and add transactions as they occur. You can also control when the envelopes are “refilled”. With your free account, you have 10 monthly envelopes for budgets like groceries, gas, and bills, along with 10 annual envelopes (great for vacation savings or holiday gifts).

Adding the transactions is pretty simple, and you can even split the transaction between multiple envelopes. Once you log your transactions, you can view the breakdown of your spending with colorful, easy-to-read charts.

5. YNAB encourages you to be willful and money-conscious.

Website | iOS | Android

$14.99/month or $98.99/year

*Students get a free one-year trial. A 34-day free trial is also available.

While this technically isn’t part of the best free budgeting apps, many readers find it worth every penny, so much so that we had to include it! YNAB, which stands for You Need a Budget, does an excellent job at steering you to become intentional with your money and saving as much as you can.

According to many reviewers, it takes a few weeks to become familiar with and learn YNAB’s system, but once you do, it’s smooth sailing, and you’ll be saving big and paying off debts in no time!

“Love YNAB – have had it for years. Paid off our home early using it to help manage our money. For those who have unexpected expenses – the goal would to be to create sinking funds. For example, if you know travel is expected, put $100 (or whatever) every month into a travel category. It will add up and be available when it is needed. We use this method all the time. School fees are hundreds of dollars in August, so we put aside money every month so we are prepared.” – Hip2Save reader, Jill

6. Every Dollar is extremely versatile.

Every Dollar allows you to easily customize your budget, plan your savings, and reach your financial goals. You can connect your bank accounts to this app, and it lets you create individual “funds” for all sorts of items, like groceries, shopping, etc.

Many reviewers also love how you and your spouse can share an account and take control of your budget together, improving your likelihood to achieve goals!

7. PocketGuard is perfect for cash lovers.

Website | iOS | Android

FREE | PocketGuard Plus available for $3.99/month to add cash account and additional features

Treat your cash like, well, cash! PocketGuard takes the information from your synced financial accounts to give you the scenario of what “cash” would be in your pocket. Like the rest of the apps, adding financial accounts is pretty easy. Once added, PocketGuard helps determine which transactions are reoccurring so you can easily identify bills and subscriptions.

This app is pretty no-nonsense and straightforward, and I really like that you can categorize transactions with #hashtags to group spending that may not fall into a typical monthly budget. For example, you can use #DisneyTrip to categorize expenses for an upcoming vacation or #ChristmasGifts for higher-than-usual spending around the holidays.

The basic version of the app is free (and really has all you need), but you can upgrade to add in a “Cash” account for any money you don’t have tied to an online banking system.

8. Debt Payoff Planner creates simple payoff strategies.

Website | iOS | Android

FREE | Debt Payoff Planner Pro Plan available for $2/month to add additional features

To create the best payoff plan for you, Debt Payoff Planner collects your debts, APR, and minimum payment. One reader spoke highly about this app, noting they email you weekly and show you how to save on interest. Tailored to your financial situation, your plan will help you pay off your debt as quickly and efficiently as possible!

The free version offers the tools most people need regarding debt relief, but it’s recommended to invest in the Pro Plan if you’re in a more critical debt crisis.

Check out some other ways to save money you may not have tried!

My problem is that I can’t budget because we never know when my husband’s going to have to travel, that includes eating out and other expenses. just the other day we had to take one of our dogs to the vet and that expense was almost $3000.

I like to think of it as a spending plan. Since he has to travel, but you don’t know when, maybe building Travel into your budget by setting aside money each month?

You can budget, you’re just not budgeting. I don’t understand how that “oh well” mindset has become so common about finances. As the other poster said, include it and build it in, just as you should build in an emergency fund.

Debt Payoff Planner is gold. Really surprised it didn’t make the list. It has a free or a paid version. Sends weekly emails, helped me see how much I’ve saved on interest, how much I’ve paid off, and when the payoff date should be. Super amazing app.

Love YNAB – have had it for years. Paid off our home early using it to help manage our money. For those who have unexpected expenses – the goal would to be to create sinking funds. For example, if you know travel is expected, put $100 (or whatever) every month into a travel category. It will add up and be available when it is needed.

We use this method all the time. School fees are hundreds of dollars in August, so we put aside money every month so we are prepared.

I’ve used Mint for over a decade. Love it. Very eye opening to see where my money goes. I don’t really budget but tracking my spending and seeing what categories I spend my money is very eye opening. It auto inputs all your spends once you add your login and username to each of your accounts. Also shows your net-worth, which a lot of people don’t know. I love looking at the trend charts after a year.

Oh wow! Great that you’ve been able to check the data on your finances so easiily! Thanks for sharing with us! 💞

YNAB is the best! We’ve used it for at least 5 years and it has helped tremendously. It works well in creating a budget for items that pop up throughout the year but may not happen monthly like vacation, pet bills, etc. It does cost money but I’ve found that it’s worth it and they make budgeting so easy and even a little fun.

It’s always good when budgeting is fun! 🙌🤗Thanks for sharing what you’ve liked best, Tess!

I’ve been using the free version of EveryDollar for years, and absolutely love it! I would say this…even if you can’t get yourself to do a budget, just use it to track your spending. To me that is the first key to getting money under control, because most people don’t have any idea just how much money they spend on certain things.

Thanks for sharing about the app you use, Jennifer! I agree that tracking spending really is an eye-opening experience to see where your money is going! 💕