Received Advance Child Tax Credit Payments or a 3rd Stimulus Check in 2021? Watch Your Mailbox for Important Tax Info

Tax season will be a little different this year if you received Advance CTC or EI payments from the IRS.

In 2021, the IRS provided some financial assistance to Americans in the form of a third Economic Impact Payment and monthly Advance Child Tax Credit Payments.

The Advance CTC Payments were sent out monthly to eligible families via direct deposit or check. Qualifying families received a total of 6 payments of up to $300 per month for each child under age 6, and up to $250 per month for each qualifying child ages 6 to 17. These monthly payments spanned July through December of 2021 unless eligible families chose to opt out.

Recently, the Internal Revenue Service announced that it is issuing information letters to anyone who received Advance Child Tax Credits or the third round of Economic Impact Payments in 2021.

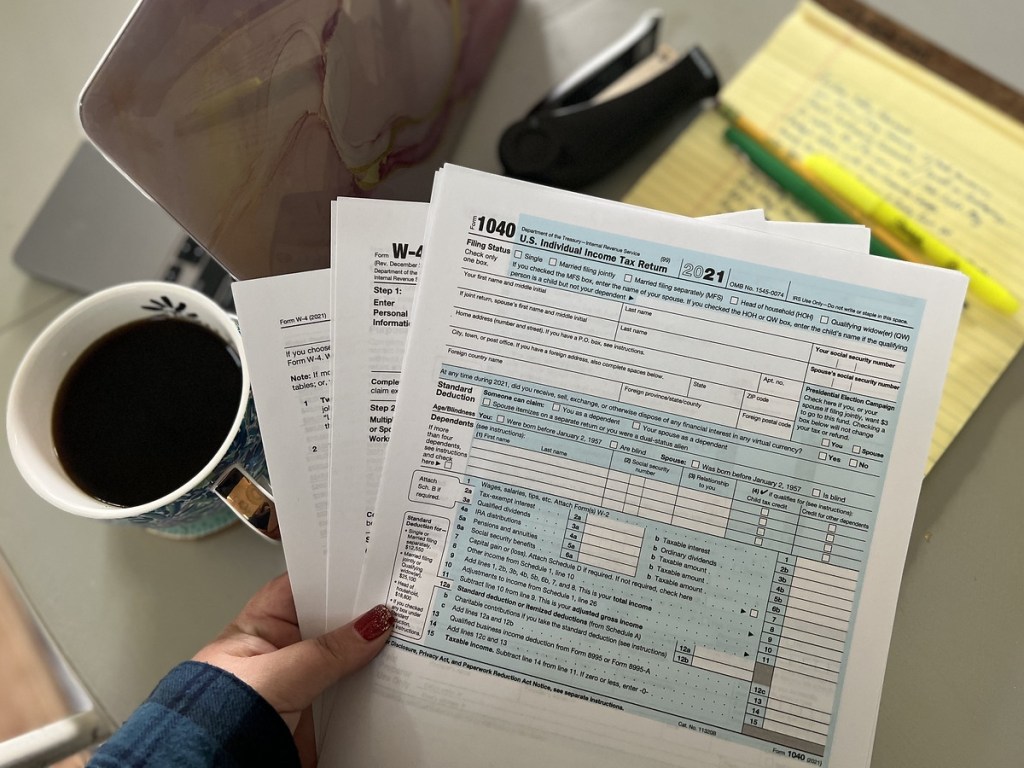

If you received either of these payments last year, be sure to watch your mailbox and then keep these letters with your 2021 tax documentation when you receive them. Using this information when preparing your 2021 federal tax return can simplify the process, reduce errors, and cut down on processing delays.

The IRS is sending out a separate letter for each type of payment issued in 2021. Letter 6419 will go to recipients of the 2021 advance CTC, and Letter 6475 will be sent to recipients of the third Economic Impact Payment.

If you received letter 6419 from the IRS (which was sent out in late December), it should include the total amount of advance Child Tax Credit payments your family received in 2021, and the number of qualifying children used to calculate the advance payments.

Families who received advance payments will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return. If you misplace this letter, you can also check the amount of your payments by using the CTC Update Portal.

Eligible families who opted out or did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return. This includes families who don’t normally need to file a tax return.

The IRS will begin sending out Letter 6475 to Economic Impact Payment recipients in late January. This letter will help EIP recipients determine whether they are entitled to claim the Recovery Rebate Credit on their 2021 tax return.

This letter only applies to the third round of Economic Impact Payments issued from March 2021 through December 2021. The third round of Economic Impact Payments (including the “plus-up” payments based on a 2019 tax return or information received from SSA, RRB, or VA) were advance payments of the 2021 Recovery Rebate Credit that would normally be claimed on a 2021 tax return.

Most eligible people have already received their payments, but anyone missing stimulus payments should review their information to determine their eligibility and whether they need to claim a Recovery Rebate Credit for the 2020 or 2021 tax year.

As the 2022 tax filing season approaches, the IRS is urging people to use electronic filing with direct deposit to avoid delays. If you’re looking for a way to file your taxes for free this year, check out these helpful tips.

More information about the Advance Child Tax Credit, Economic Impact Payments, and other COVID-19-related tax relief can be found here.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

We tried to opt out and spent about an hour trying to be verified by ID.me. We were then were told we had to wait on hold for a virtual teleconference with someone to verify it was us. Just gave up and we are setting this money aside as well.

I verified from my phone and it was much easier! You open your camera to do a short video.

accountant here. If your financial situation is the same as last year, and you got a refund more than last years child credit ($2k per child) then use the payments now to build an emergency fund or to budget for holiday shopping. If you got back less than the child tax credit amount, run your taxes now. If you dont know or dont want to figure this out, go in and opt-out.

There will be some unhappy people next year who dont know that this is half of that credit, so if you usually get a refund, it is less than usual. Honestly, if the inflation continues how it is, you will be able to buy more with that money now then you will be next year.

Right. But you get $1,500 in 2021 of that $3,000. Then the other $1,500 on your taxes instead of $2,000 like in 2020. So depending on your tax planning and you income status, it may be a $500 variance. If you plan accordingly, you could save that money in case you had a pay it back. IMO, that’s better than having the government hold onto your money for several months (interest free, I might add). ^ I’m a CPA.

Totally agree with you. I field all of these questions in a tax office. But unfortunately, as i said if clients usually owe, this will only increase what they owe, probably by around $500. At least 80% of the public won’t be responsible enough to set money aside and will be in full blown panic when they owe. Often having to set up payment plans with the irs, even for amounts $500 or less. Most also won’t understand why the numbers differ from last year. Sad but true.

Tax guidelines are always as of 12/31 of whatever year. So if they are 6 by 12/31/21, you get the lesser amount.

Taxes this year should be fun. We opted out of the Child Tax Credit way back in June (went through all the looooong process of it all) to still get money sent to us monthly. Called the IRS who told us to send back the money along with a detailed letter to fix the issue and no longer send money. Again, everything they said for them to STILL send us that money monthly. I have photocopies of everything but still what a HUGE waste of time for them to do nothing. Ugh 😑

We recently moved. How do I let the IRS know my current address??

You go to IRS.GOV, look up how to change address, then follow the instructions. It’s a very simple process.