Have a Hard Time Saving Money? You NEED This Budgeting App!

“Saving money is so simple!” … said no one ever.

I’d like to think I’ve always been financially responsible. I know how to budget, I paid off my student loans six years early, I have a great credit score, and I jump at any opportunity to learn about money management. But if I’m being honest, actually getting money into my savings account is not an easy task for me.

And I don’t know why! I see my paycheck clear, I pay my expenses, and I should just be transferring the leftover income into my savings. Am I worried I won’t have enough left in my checking account? Or am I really that lazy to set up the transfer? I think it’s a mix of both, maybe with a higher focus on the latter.

That’s why Digit has become a must-have for my smartphone screen. Let me tell you about this glorious app.

What is Digit?

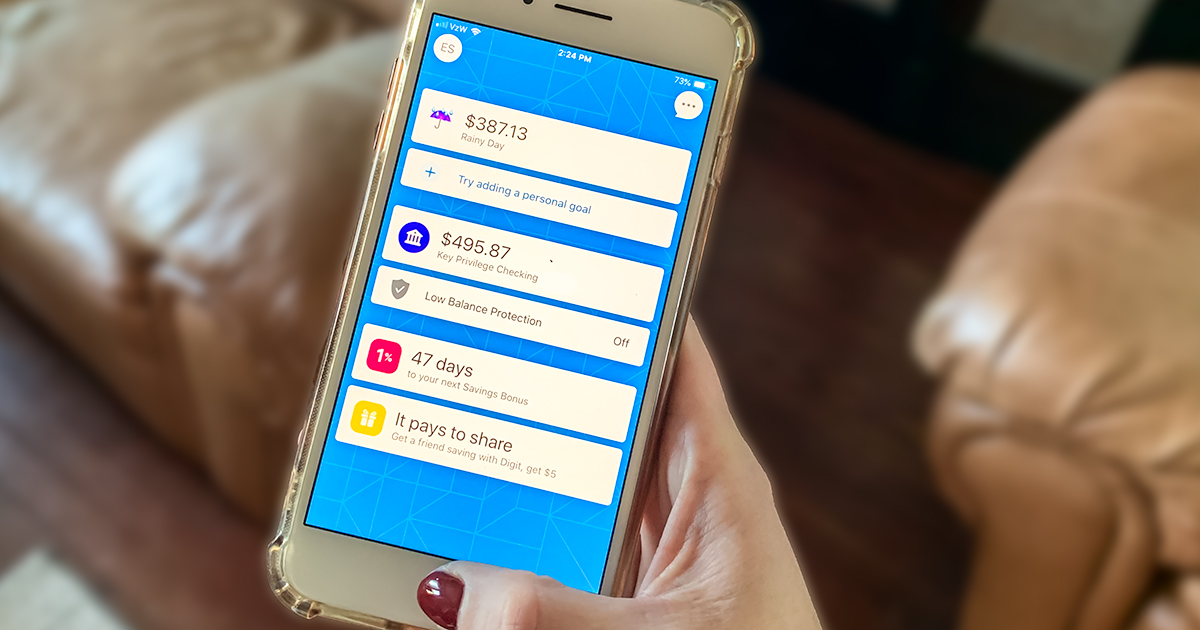

The Digit app connects to your bank account to move small amounts of money from your checking account into a Digit savings account on a daily basis. By transferring smaller amounts, users are less likely to notice the money leaving their checking account, but the accrual in savings is huge!

I have never noticed the money leaving my account yet since downloading this app back in February, and I’ve already managed to save nearly $2,200 with this app.

Going from having no sense of savings to socking away $2,174 in savings over the course of a year is a HUGE accomplishment for me. And I wouldn’t have been able to do it without this helpful little app! There are some key features that make this budgeting app pretty much perfect:

1. Set up is simple.

Sign up and connect your bank account so that Digit can pull small amounts from your checking into a savings account in the app. With smart algorithms, it will also check for upcoming expenses, checking balance limits, and previous expenditures so that it won’t transfer more than you can afford. Transferring money for your Digit savings to your bank checking account happens in the click of a few buttons (and without any fees).

2. Transfers are automated.

Set it and forget it! The daily transfers are automated so you don’t even have to think about moving the money around. You can also sign into the app to see pending transfers, set a max for the daily transfer amount, or pause saving for more control.

3. It keeps you updated with your balance and milestones.

Curious about what’s happening in your banking account? Digit will send you a daily text to let you know your current balance, as well as recent transaction amounts (if you’re wondering what caused the balance to change). By texting back the word “Recent”, you’ll be updated with more information about each transaction — all without having to log into your banking app!

4. You’re protected from overdrafts.

If you’re ever worried about your checking account dipping too low, you can set up your Digit savings as a backup to fund your checking account if it’s under a specific dollar amount. Yay for avoiding overdraft fees from your banks! Oh, and if you do happen to have an overdraft from not having enough in your checking account, Digit will foot the fee bill.

5. The app rewards your good saving habits with bonuses!

While keeping money in your Digit savings account won’t yield you any interest from the bank, the app does offer savings bonuses. Every three months, you’ll receive 1% of the average balance in your Digit savings account. That could potentially be more than what your bank offers!

And this is just the tip of the iceberg! There are even more features you can use from Digit that I have yet to take advantage of, such as paying credit card bills directly from the app, creating multiple savings accounts for specific expenses, and Apple Watch integration.

I will say though, this app does eventually cost some money. It used to be free for the first 100 days, and then $2.99 per month after the trial period. Unfortunately, the company recently cut down that trial period to a mere 15 days, which is a huge bummer! To many, the monthly fee may be a deal-breaker (I get it because paying money to save money is pretty counter-intuitive). But for me personally, I think it’s 100% worth it as I would have never been able to save $2,200 on my own.

All in all, I’m learning healthy money-saving habits, so I can eventually meet my financial goals without the assistance of external apps. But until I work at them entirely on my own, I’m so excited to watch my savings grow thanks to Digit!

Hi, how long did it take you to save the $1800?

She says 10 months in her post.

Hi Suzan! I’ve been using the app since February of this year, so roughly 10 months! This total will vary for everyone based on how the app calculates the daily savings amounts. Hope that helps!

I don’t want any kind of app having access to my checking account. That’s how people’s information gets stolen.

I am with you there!

Among other things. I agree.

Giving anyone or anything control over my banking accounts gives me major anxiety. I’d be more interested in a more hands off savings app which maybe SUGGETS savings and makes it my choice to transfer.

I agree! An app that you can follow daily or even weekly and let you transfer the money yourself! I’d have way too much anxiety about giving them access!

We use Qapital and there is NO monthly fee. We love it. We have a trip account and a college account for my son.

Qapital sounded intriguing so I looked it up and it seems like it is no longer free:

Qapital Pricing and Plans

As of November 2018, Qapital changed its free structure into a membership based structure. If you’re an existing Qapital member, you’ll automatically get access to the highest tier.

For everyone else, you get a 30 day free trial, before you have to start paying. You can try Qapital here for 30 days free.

The plans are:

Basic ($3/mo) – The basic plan gives you access to Qaptial’s saving, spending, budgeting, and investing tools. It also allows the goal based approach they are known for.

Complete ($6/mo) – The complete plan is an all-in-one financial solution. The goal is to seamlessly integrate Qapital’s tools into a complete picture for you.

Master ($12/mo) – The master plan is for people that want a greater understanding of their money. You get all the options of the lower plans, but also exclusive webinars and in-app challenges.

I wish my bank app would allowing for separate “buckets” and budgeting my money.

If you haven’t reached the limit, you could create a separate bucket by opening another account.

Hi Mrs. G! I’m glad you mentioned the Qapital app because someone recently mentioned it to me. I haven’t checked it out yet but I plan to soon! That’s great it’s been working well for you!

That’s so cool!! If you don’t mind me asking, what did you set as your goal???

Hi Yesenia! So I actually didn’t set a goal — I was just trying to build up some savings, regardless of the end amount. BUT I’m working to save up for a down payment on a house so this is certainly helping me learn better savings habits to get there!

I’ve been using Digit for several months and LOVE it. It doesn’t pull a ton of $$ and you can customize what u want to save for. I have over $300 saved so far. 🙌🏻

That’s awesome, Jill! I’m happy to hear other readers already like the app too. Enjoy your savings!

I have tried this app. In theory, it was working well. One thing I hated though…when I really needed to pull money back out in a pinch, it took forever for it to get back into my account! That is the reason I cancelled. When I needed the $, I needed it right away! It didn’t feel right to have to wait several days for MY money.

Hi Arica! That’s such a bummer and I totally understand that frustration! I’ve pulled the money out twice and it was transferred to my checking account the next day, though I’m sure there’s some variation between banks and non-business days.

I already have that with my Bank of America checking account, you can auto transfer from your checking to your savings account. As the wife of a banker, I am very weary of apps having access to my checking account number.

I agree we already do this with Wells Fargo. We have set up an automatic transfers to savings every month.

This is what we do as well. We also set up additional savings accounts that have auto withdrawal for trips, car repairs, home repairs/purchases, etc.

We use Qapital to save for our anniversary trip. My husband does automatic payments into a savings account at a different bank. We don’t use that bank so the money stays put.

I notice they charge $2.99 fee after 30 days

Looks like many of us want to save money. I am in the beginning stages of becoming a financial coach. If you are looking for some assistance in getting control of your money please feel free to reach out. I would love to help you! We work too hard to not utilize every last penny. Feel free to contact me at jessvanderlaan11@gmail.com

Thanks for the consideration

I don’t let anything have access to my checking and savings accounts, not even Paypal. I disconnected my savings account from my debit card so it couldn’t be accessed from an ATM.

The Capital One app categorizes most transactions in my checking account. It doesn’t categorize credit card payments from my checking account or my electricity bill. The app does categorize credit card payments on the credit card tabs. The categorizations don’t show up on the website.

The app allows me to transfer money myself or set up a recurring transfer. I can go to the website and enable daily balance and transaction emails and text alerts. I have the transaction alert set to anything over $0.00. I also have an alert set for when a pending charge posts. The app will let me set alerts for my credit cards but not for my bank accounts.

I opted out of overdraft protection. I would rather the bank deny a charge if it would overdraw. A thief can’t overdraw my account this way.

The app lets me manage both credit cards, my checking account, and my savings account. I could open more savings accounts if I wanted to. I would be able to access all of them in the app.

I only have one savings account because I want to earn as much interest as I can. Smaller amounts in multiple accounts will earn less interest overall.

Super scary! If you don’t notice yourself saving you won’t notice if they make “mistakes” and your money disappears. Also, if they charge for this service, you’re not really saving $…

Hey Sandra, I totally get what you’re saying! Let me clarify though — when I say I don’t notice, I mean that the daily transfer amounts are small enough where I don’t see any glaring errors in my checking account. I use another budgeting service called Mint that lists ALL my transactions, and I track that almost every other day, especially recently with all the holiday spending. And yes, it is a bit strange to pay money to save money, but I don’t believe I would have been able to save as much as I have without the app (so I find the fee worth it). Eventually, I’d like to save without having to use the app and pay for it, but as of right now I’m using it as a learning tool. ☺️

Check your Moe’s app for free cup of queso and chips

Cool! Great idea! I’ve got a pretty lofty savings goal to reach for 2019- this will help! It says there’s a reward for referring friends, how can we get you that reward if we sign up?

By clicking on the links in the post.

Try fudget! It’s awesome, it’s like balancing your checkbook but soooo much easier. I use it on vacations so I can look back and see what we spent money on so I can plan better for next year!

$1800. From 10 months comes to about $6.42 each day. I personally save $50 from each paycheck. I set up automatic deposit every pay day, goes into a Xmas club at the credit union I bank at. And it doesn’t cost me anything!

That’s another great idea! Such a good way to move and save money by having it automatically drawn from your bank account.

Read Dave Ramsey Total Money Makeover people! It’s truly life changing if you follow his plan.

Maybe someone knows more about Credit Card offers and the way it effects scores? What do you think about opening CC accounts with $ 200 – $ 500 cash offers for 1st $ 3000 spent or so? I am very good at budgeting and saving and I ALWAYS pay my CC off in full, each month!!! Recently my friend shared with me that I should (he does it all the time) take advantages of those CC offers mailed to me and earn hundreds of dollars throughout the year…

I take it opening an closing those accounts will lower my high credit card score? Or would it recover/go back up fast? I wouldn’t mind all those rewards and savings while always paying off my CC in full. Some even have $ 500 cash back!!!!

Closing the accounts would lower your score, because part of the score is based on credit account age. Check out reddit.com/r/churning. Per their guides they want people to learn a lot about doing that before actually participating, so you don’t make mistakes.

I like the idea behind it, it does sound like a great savings plan. But having to spend money just to save money seems counterproductive. most banks will let you set up automatic transfers to savings account, or even an account at a different bank.

I personally have two checking accounts at my bank, I know how much I need in my in the account each week to cover bills. I’ve set up automatic payments for most of my monthly payments on utilities that come out of the separate checking account. I also have automatic transfers to savings account for my kids and I. Doesn’t cost a thing.

I just started using Qapital as well! I opted for the “Round Up” feature, so everything going through our accounts rounds to the next dollar and the difference goes into the Qapital savings. I have a separate checking that does that and applies it to student loans – it’s a great way to save without it being a large amount, but it adds up quick! If anyone is interested in Qapital, you can use my link and we both get $20 when you sign up! Happy saving!

https://get.qapital.com/rLtkmERr8U

Looks like the monthly subscription fee is $5/month…..not $2.99. I’m totally bummed. I was interested in trying this out but not for $5/month.