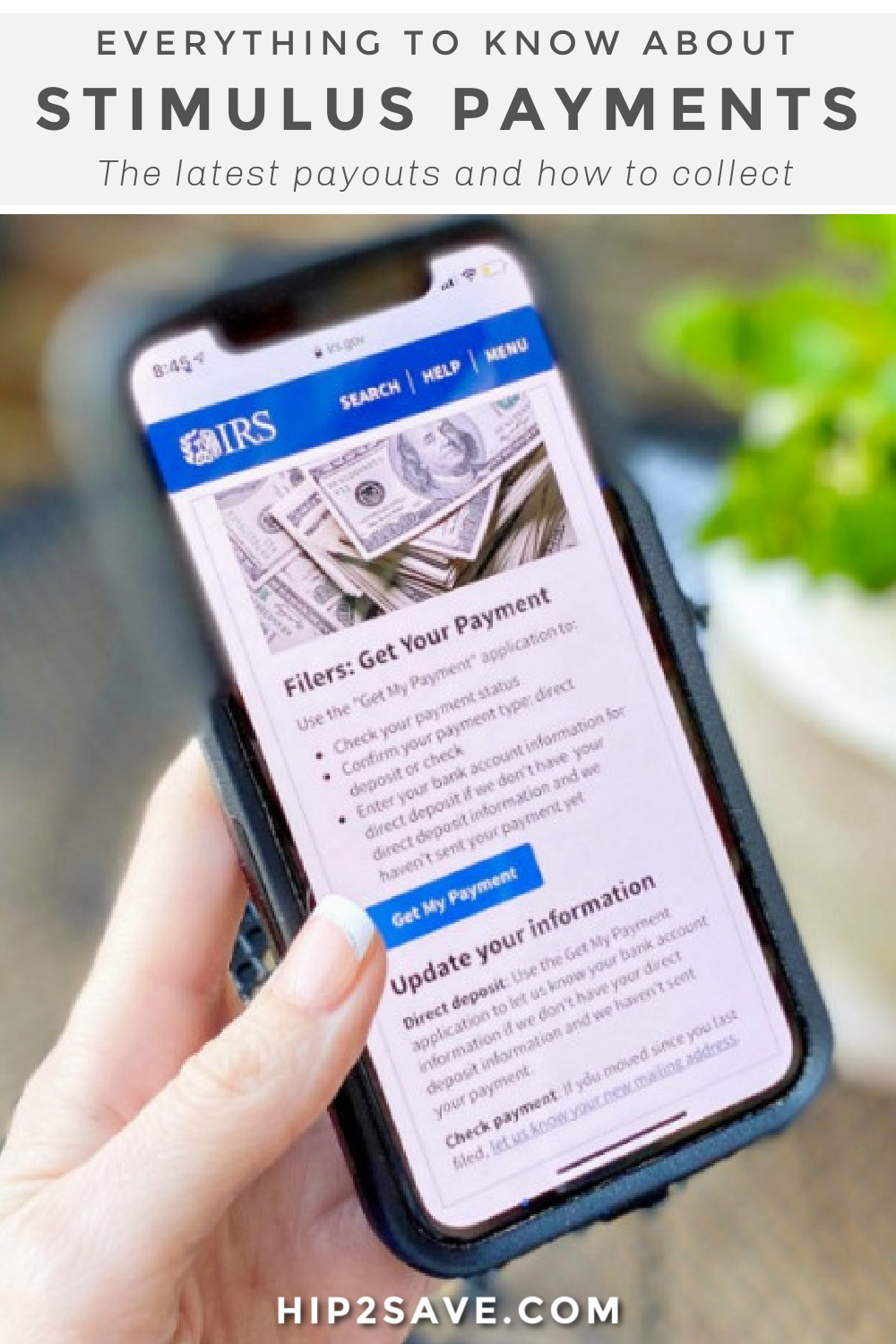

Several States Are Sending Out A Stimulus Check in 2022 (Are You Eligible?)

A state stimulus check might be headed your way in 2022.

Some states are providing economic relief via tax rebates.

Though the federal government probably won’t send stimulus checks in 2022, you might be receiving some help from your state. In the latest attempt to combat inflation and stave off a recession, well over a dozen states have decided to send income tax rebate checks to their residents. Most of these refunds are for small amounts (so don’t get too excited) but we do have the scoop on who qualifies and when to expect a payment!

Find your state below and see if you qualify for a stimulus payment:

California

Who qualifies:

- Single taxpayers who make less than $75,000 annually or couples who filed jointly that make less than $150,000 annually will receive $350 per taxpayer and an additional $350 if there are dependents.

- Single taxpayers who make $75,000 – $125,000 annually or couples who make $150,000 – $250,000 can expect $250 per taxpayer and an additional $250 if there are dependents.

- Single taxpayers who make $125,000 – $150,000 annually or couples who make $250,000 to $500,000 annually will receive $200 per taxpayer and an additional $200 if there are dependents.

When: First payments will go out as soon as October in the form of a direct deposit or debit card.

Colorado

Who qualifies:

- State residents who filed their 2021 returns by June 30 qualify.

- Individual filers will receive $750 and joint filers will receive $1500.

When: If filed on time, expect a check by September 30, 2022. Those who filed an extension will see a check by Jan 31, 2023.

Delaware

Who qualifies:

- State residents who filed their 2020 and 2021 tax returns qualify and can expect $300 per adult.

When: Checks will be sent out from May 2022 through the end of Summer 2022. Adults who did not file timely may also receive a check after October 17, 2022.

Georgia

Who qualifies:

- Full-time state residents who filed their 2020 and 2021 tax returns timely. If you filed an extension, you have until October 17, 2022. Part-time residents will receive a proportional refund.

- Single taxpayers will receive $250, heads of household will receive $375, and married couples filing jointly will receive $500 together.

When: Payments began going out in May 2022.

Hawaii

Who qualifies:

- Single taxpayers and heads of households making under $100,000 will receive a $300 return.

- Married taxpayers filing jointly and surviving spouses who make under $200,000 will also receive a $300 return.

- Individuals who make above $100,00 and couples who make above $200,000 will receive a payment of $100.

When: Payments will come via direct deposit or paper check beginning at the end of August 2022.

Idaho

Who qualifies:

- Full-time residents who file their 2020 and 2021 tax returns by December 31, 2022, are eligible for a payment of $75.

When: Payments started in March 2022 and were sent out via direct deposit or paper check. You can track your rebate payment on Idaho’s State Tax Commission website.

Illinois

Who qualifies:

- Individuals who earned less than $200,000 in 2021 (and were full-time residents) will receive a $50 income tax rebate.

- Couples filing jointly who earned less than 400,000 in 2021 will receive, together, a $100 tax rebate.

- Those with dependents can collect $100 per dependent with a maximum of up to 3 dependents.

- Illinois residents may also qualify for a property tax rebate or other economic relief under the Family Relief Plan.

When: Payments begin starting September 12th, 2022, and will be sent in the same method that your original tax refund was sent.

Indiana

Who qualifies:

- All state residents that filed their 2020 taxes before January 3, 2022, will receive a $125 taxpayer refund.

When: Payments should be received by September 1, 2022, and will come in the form of a direct deposit or check.

Maine

Who qualifies:

- Full-time Maine residents who filed 2021 tax returns (and are not listed as dependent on anyone else’s return) qualify for a payment if they file by October 31, 2022.

- Single taxpayers who make less than $100,000 qualify and will receive a payment of $850.

- Heads of households who make less than $150,000 qualify and will receive a payment of $850.

- Couples filing jointly who make less than $200,000 qualify and will receive a single payment of $1,700.

When: Payments started in June 2022 for those who filed timely.

Massachusetts:

Who qualifies:

- If relief is approved, individual taxpayers who made more than $38,000 but less than $100,000 in 2021 will qualify for a $250 payment.

- If relief is approved, couples who filed jointly and made no more than $150,000 in 2021 will qualify for a $500 payment.

When: If implemented, your stimulus check will be issued before September 30, 2022.

Massachusetts previously provided relief for eligible low-income workers. If you had a household income at or less than 300% of the federal poverty level and did not collect unemployment, you should have received a stimulus payment of $500 earlier this spring.

Minnesota

Who qualifies:

- Frontline workers who were employed at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021. Review the eligibility guidelines and apply for the payment before July 22nd, 2022.

- Frontline workers with direct COVID-19 patient contact qualify if they made less than $175,000 or $350,000 if filing jointly.

- Frontline workers without direct COVID-19 patient contact qualify if they made less than $85,000 or $185,000 if filing jointly.

When: Payments are anticipated to be sent in Fall 2022.

Gov. Tim Walz has also proposed an income tax rebate that is yet to be approved. His proposal is for a $1,000 relief for individual taxpayers making less than $165,000 and a $2,000 relief for joint filers making less than $275,000.

New Jersey

Who qualifies:

- New Jersey residents qualify if they filed the NJ-1040 in 2020 and have at least one dependent.

- Individual taxpayers who made less than $75,000 are eligible.

- Surviving spouses, heads of households, and couples filing jointly who made less than $150,000 qualify.

When: Checks began being mailed on July 2nd, 2022. New Jersey residents might also qualify for property tax relief which will be a separate payment.

New Mexico

Who qualifies:

- Individuals filing separately qualify for a $250 rebate if they made less than $75,000 in 2021.

- Married couples filing jointly, heads of households, and surviving spouses who made less than $150,000 in 2021 are eligible for a $500 tax rebate.

When: Payments for relief above begin in July 2022. New Mexico also offered two other separate stimulus checks. One was mailed in June 2022 and another will be sent in August 2022.

New York

Instead of income tax relief, New York has issued property tax relief for homeowners.

Who qualifies:

- Those who qualified for a 2022 School Tax Relief (STAR) credit or exemption are eligible for up to $1,050 provided their 2020 income was less than $250,000 and their school tax liability for 2022-2023 is less than their 2022 STAR credit.

When: If you qualified, your stimulus check was sent out starting in June 2022.

Pennsylvania

Like New York, Pennsylvania has issued property tax relief for homeowners.

Who qualifies:

- Homeowners who applied to the MyPath program and fit the eligibility requirements listed below.

- Homeowners are eligible for a maximum rebate of $650 if they make less than $35,000 (or are a renter who makes less than $15,000) and are seniors above the age of 65, have a disability and are at least 18 years old, or are a surviving spouse age 50 and above.

- Seniors in need may qualify for additional relief.

When: Check the status of your rebate using the “Where’s My Rebate?” tool.

South Carolina

Who qualifies:

- Any state resident who paid taxes this year is eligible for an income tax refund.

- Those that paid $800 or less will receive a full refund.

When: Payments are expected to be sent in late November and December.

Virginia:

Who qualifies:

- Only taxpayers with a tax liability last year are eligible.

- Individuals filers will receive $250 and those who filed jointly will receive $500.

When: Payments are expected to be sent via direct deposit or stimulus check starting in late September 2022.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

We received ours but didn’t include my son that just turned 18. I’m guessing he’ll get his own check? Hope so.

If he files taxes he might. The child credit is for kids up to 16

If you listed him as your dependent on your taxes you will not receive any $. I have a 19 and 21 and we did not receive any funds for them.

If you claim him as a dependant then he will not get one. You cannot claim him. I know it doesn’t seem fair. We are in the same boat.

I think your son is in the no money zone like mine, and most college kids. If they can be…even if they weren’t…claimed as a dependent then they get no check.

Why would he unless he filed his own taxes and no one could claim him as a dependent? If he was working like most 18 yrs old should be, he should have filed for Unemployment Benefits under the Covid19 Bill and he will receive an additional $600 a WEEK.

Mine was deposited to an account I havent used for direct deposit in almost 3 years,. And the account is closed.

Unbelievable. Says right on the page before checking the status that they used 2019 income tax info. Or 2018 if 2019 wasn’t done yet. I can assure you, no, they did not

Same here. They’re completely full of ****

Agreed Derrick. I’m one of the lucky ones who can afford this mistake, but it’s still crap.

Im in a similar situation to where I just filed my 2019 taxes and my stimulus check was suppose to be deposited today. Its going into my closed checking account from my 2018 tax return. Im still on the wait with my old bank to see how they handle this. I still have a credit card with them. Have you spoken to anyone on how to resolve this? I wonder if the IRS will try our account on the 2019 tax return since they should have gotten some kind of error when transferring to a closed checking account.

This happened to me as well. I was on the line with the bank on hold for 3 hours and they told me that nothing came through so the bank must have returned it, they than transferred me to a different department and no answer at all. This is crazy they should verify the account first before depositing these checks..

From my understanding because that is what happened to my son, and I was on hold for an hour for them to tell me that it will reject but it could take up to 2 days and then the IRS will issue a paper check which will take forever

Same exact thing happened to me. On the phone with the bank for 3 hours. They should of went off of 2019s taxes. Will they send paper checks instead?

Did you figure it out? I’m on the phone now with my closed account too 😑 I’m hoping if they do mail it it comes to my new address because I did change that via post office but it’s late says up to 15 days after if you did not receive payment

This happened to me and the bank said it will be sent back. I am not sure how or when IRS will reissue. Does anyone have any information on this?

Same situation, my bank told me they would return the funds to the IRS within 2 days.

Same we me man mines deposited into a closed account

mine too

@bruce, If account was closed what happened to the check? Did bank send this back?

Im still on hold with my bank. They see it it in a pending status to the closed account and they are seeing what they can do. They transferred me to a “specialist”. If it comes down to the IRS having to mail a check to me, I wont trust that either, as I moved last year. They pulled an old bank account somehow so who knows what they’ll use as an address.

Ask your bank too force open your account after reading these comments I was worried as I awaited my bank to call me back. They said they can reopen my account or force open it and I should receive my funds tomorrow.. fingers crossed and hope this helps some of u

@Andrew Eckert – Thanks Andrew. Im on the phone with them still. Their phone connection awful. Ive waited and waited. Got a helpful gal who kept breaking up on me. She transferred me to the specialist who kept breaking up as well until finally losing her altogether. Called back, waited 35 minutes and got disconnected. So here I am again. Hopefully Ill get back to this specialist before its too late. Oh well, small thing in life really. I can afford this mistake, hopefully others that cant don’t have to go through this. Though it appears to be happening to lots of folks.

I dont understand why we couldn’t update our information before the government sent our stimulus check. You know some people actually need this money for bills not just to party with or blow like I have seen many doing.

This same exact thing has happened to me. States all over the IRS.gov website that they will use 2019 tax return details to calculate and process payment if you have already filed your 2019 return. I filed my 2019 return on March 18th. yet they used my 2018 tax return info instead and now my payment was sent to my old closed account at a different bank.

NOW WHAT?? Can contact anyone to get it resolved so we’re just SOL?!?!?

I feel your pain. Mine also went to an old account. I filed through turbotax, and two representatives assured me it would be in the current account. Now, when I spoke to them today, they said there is nothing they can do. It is going to get returned to the IRS and mailed to me, which will be to an old address. There probably isn’t any point in trying to update my address with the IRS because it takes 6 weeks. The headache isn’t worth it. I am over it.

I updated my address over the phone with the IRS and it became effective immediately

What number did you use?

I FINALLY spoke with a specialist at my bank, and she stated that because I do have a current account with them that once its rejected from the closed account (its currently pending), it should go to a report where someone will then move it to the open account tomorrow morning. The closed acct was from when the bank was under a different name though. Current bank bought them out. So she is going to get back to me with verification of this process. Good luck to you all with yours!!

WHAT DOES THIS MEAN According to information that we have on file, we cannot determine your eligibility for a payment at this time? I HAVE DIRECT DEPOSIT

we got this same message….. why bother putting this out if they “can’t determine eligibility”.

I had the same comment and not only that, they “accepted” my 2019 return and took out my payment today too lol.

I’m sorry but I wanted to ask what do you mean by they took out your payment today? I’m trying to get some type of help because I’m getting the same answers both you two got

Exact same thing happened to me. You take a payment out my account but deposit my stimulus to a old closed account

I got the same thing! And you can’t even call to find out why!

I got the same thing. Checked back two hours later and it says I’ll be getting a direct deposit tomorrow. Check again. I think it was just a glitch 🙂

Are you self-employed, havent filed or SSI if so that is why. They are disbursing the 2018 and 2019 filers first because all of my children got theres and I did all of their taxes but my son that filed 2018 the bank is closed and they said it will be held for 2 days (Wells Fargo) then kicked back basically so make sure the address is updated.

I know several people who are self employed who got theirs this morning…I’m self employed, file every single year! and filed for this year 2 weeks ago…got my refund for THAT early…

I got the same message quite a few times – I tried on both Safari and Chrome. I just wanted to give bank acct. info. I know we’ll receive one but just wanted to, hopefully, receive sooner. I think it’s just a glitch in the system and hope that it will be resolved within a few days so I can give bank info.

What happens if the account it was sent to was closed? Will they still at least mail it? Or will I basically not get it?

I filed this year and my current direct deposit is on file. They sent it to an account I’m not familiar with. Does anyone know if there will be an option to update this or will you have to wait for a letter with instructions as theirs does not have live operators

The same thing happen to me. Have you got any information?

This same situation happened to me also. Can’t contact anyone at IRS either.

I received my 2400 for me and my wife. But not the 500 for each kid. Our kids are 8, 5, and 3. Anyone else have this problem or know what can be done to get the other 1500?

I received my deposit of 1200 but did not receive my childs deposit. Who is only 14. Will they be depositing separately??

Yes I had this issue also! I got 500 for one child but not the other….. anyone know what to do?

Up to 1200 for adults and 500 additional qualifying child which they changed to 16 it use to be 18. SMH. We all most of our children is still in the home even after 18

Received $2100 today, 2 adults and 2 kids (3yo and 1yo).

So many questions. No answers.

I too had my direct deposit sent to a closed checking account, after updating all info on 2019 Taxes, that were received and accepted by IRS. NO help can be found on IRS website, nor any numbers to reach a person to speak too.

What do you do if your direct deposit account number shows the last four of your social security number, for the payment? Like it’s not showing my bank account number just the last four of my social. What does that means???? Help

I am having the same issue. I did mines through a tax company and they put my refund on a walmart card. Not sure if thats where it went because I cant check my account on line or by phone. Its like their system is down.

Mine is the same and i haven’t seen any help in this at all

Mines sayin the same thing how does my account number have my social in it

I read that checks will be seized for non payment of child support. Anyone know of this happening? I’m owed quite a bit of back child support, curious to see if it happens and if so who will get the $500 for our 17 year old if he is eligible to claim her this year.

yes, I got my check but my man did not get his because of child support, and he did not get his tax refund either.

Just curious, did he see anything in his bank account before they took the back child support? Or did it just get taken?

Did it show in the “Get My Payment” site that he was due one? I’m trying to get the info for my husband, so he knows what to expect. It says he has a direct deposit scheduled for today, but nothing is there. He does owe back child support. He’s just assuming it’s been taken. Thanks!!

Did y’all file together on taxes? Me and my husband did and we filed a injured spouse form and we got all of our taxes back for federal but they took all of ours stimulus check for my child support being behind. $3400 for it but irs.gov payment thing said it was deposited in our bank account today but bank don’t see nothing. Anyone else like this?

Did they send you a letter in the mail saying they were taking the stimulus?

Ours says it was deposited on the 15th but nothing in our account. I also filed an injured spouse last year and I got the full amount back but nothing for stimulus checks.

They did say in the news if you owe back child support you will not get it.

I thought the “Get my payment” was suppose to help people fund out their payment info. I went on and this is what I got THEY CANT DETERMINE MY ELIGIBILITY AT THIS TIME. I don’t see how this is helping me. Can someone please explain this to me because I filled out what I needed to and gave my direct deposit info and they sent me an email that said the irs has accepted my return and will began processing?

i’m getting the same message, Can’t determine, what does that even mean?

Same here and I filed 2018 and 2019 and did both my daughters taxes and my husband is on disability so we should have gotten all of it but have nothing. This message on the IRS site is scarry and confusing dont know what to do but cry and starve when poop hits the fan…and it has only just begun.

I got same message and my non filer was accepted

I filed 3 children for 2019 one is mine the other 2 are my spouses kids but I only got 1700 is there a reason why?

I’ve read that a lot of the amounts seem to be going off of 2018 taxes. So if you didn’t claim the other children last year, then perhaps that’s the difference.

We have filed our 2019 taxes, owe money. When I clicked on Get my payment, it wants information for gross income, amount owed etc. Does anyone know how to input information would it be my income or husband’s income, or the total household income. Would like input

look at your printed packet from your taxes. look for your total AGI. that is the number you want to enter.

I have an unusual question. My mom passed away on January 18th, 2020. She just got a stimulus check in her account. Will it have to be paid back? If anyone has any idea or knows of who I could ask I would be very grateful!

So sorry for your loss. I would assume they will want it back. At some point they will be available for questions. I’m sure they are crazy busy right now though.

I would assume that it would have to be paid back, just like they reverse out SS paid in the month someone passes. I’m surprised it kicked out since her SS# should be marked inactive? I would call a tax preparer to ask.

You will need to file a deceased tax return on behalf of your mother at the end of the year, especially if she earned wages in January. Sorry for your loss.

Filed turbo tax and my refund was “accepted” March 26 but irs site says “Can’t determine eligibility” why??? what should I do now?

I got my $2200 deposited into my account this morning. No problems.

My check was sent to a closed direct deposit account. I haven’t been able to find any information regarding what to do to make sure I do end up receiving the money. Has anyone had this issue and found out how to handle this? Thank you!

I’m dealing with this same issue! The person at the old bank i used to use said that they have to send it a different way once it’s returned i guess. i just wish i knew for sure!

I receive SSD and I have not gotten my check in my bank account yet what do I need to do

Probably sent to an old account or try get my payment on irs my fiancé had the same issue

How long after you give your bank info does it take to get the refund?

I read it can be as soon as 7 days. I don’t how long it might remain pending in your bank/cu account though. Many who had it post to their account today said it was pending since last Friday the 10th. I don’t know if the pending time for so long was on the IRS’ part or something the banks did.

I filed my taxes for 2019 with my updated checking account information yet I get a notification from an old account that my check was deposited to that is closed. They should sent out an email allowing people to update there information rather than taking a wild guess and assuming things this is highly frustrating especially since the IRS is on Hiatus for speaking to anyone. Wonder how this process will go now since they sent the funds to the wrong account.

They say it been sent to my bank in i don’t even have a bank can someone help me with this

In answer to Linda it’s your adjusted gross income on you 2018 or 2019 tax return.

IRS portal says its deposited today and my mast 4 of my account number match my social number I received my Walmart gold card from tax preparer can someone help

The IRS website says they sent my payment to my old checking account that is now closed. I have other accounts with the same bank. Does anyone know if the bank will look to see that I have another checking and savings account and just move the funds to one of those?

Double check with your bank because I received an email from my bank this morning saying that if the account the IRS uses for direct deposit is closed the bank will deposit it in another that you have with them.

I have 2 minor kids and claimed both last year and only received $1700

I only got for 2 of my 3 kids too.

We received ours today, but it was for a weird amount….$X,X94.10. Not sure why it’s not an even amount. Has anyone else experienced this?

Same here. I have no idea how they came up with the amount. It’s way lower than what we expected too.

Me too. We don’t owe taxes this year either so money shouldn’t be deducted. All filing was done rounded to the dollar.

It seems as though the website is experiencing issues and therefore that is why it’s stating unable to help at this time. Relax and give it a day or two they will work out the bugs and then the website will work! (Hopefully)

I got mine this morning

I live in NJ and am with TD Bank and received it.

I just filed my 2019 taxes the other night and I checked and it says they sent my stimulus to a closed account that I used for my 2018 taxes. My old bank says it will automatically be returned..but who knows how long that will take. I think they should let people update their direct deposit information if they know their old available is closed. This is so frustrating and we will probably have to wait months to get a paper check now.Has anyone found out what people can do in this situation???

You can update direct deposit starting today. I did this morning since we have gotten checks the past two years.

I know same here, i filed My 2019 taxes 3 days ago and now the stimulus check says it will be directly deposited in a old closed bank account i had . IRS is full of shit

the website says i’m getting my stimulas on today 4/15 yet it’s not there?

Me too..just checked and it says 4/15..I’m gonna wait til tomorrow then call..

Me too

Its 1 adult and 2 kids (3 &6 year olds)

Any idea y I only got 1700 instead of the 2200???

Got mine this morning too, surprised it was so fast! I filed my 2018 taxes but haven’t done 2019 yet.

Yay i got mines today!!

Same situation money got sent but not to My current bank account. Will they send a check? So frustrating

You can update your direct deposit starting today. I did this morning since we got a check this year. I hope this helps you.

Litterally checked the site and said it should be deposited today but nothing is showing in my account, not even a pending??

How late did it finally arrive. Havin the exact same issue

I am grateful to have received mine today, but am also missing $500 for my fourth child. My husband and I a married, filled jointly, and all four children are naturally ours.

Is your fourth baby an infant? Just wondering since it seems to be babies born last year have been excluded due to most of these payments being based off of 2018 returns.

There is also a max amount you can receive, could it possibly be that you reached that?

i have 19 year old daughter and she is dependent on me and she is full time student.

i didnt get her tax relief aid of $500.

why?

My understanding is that it doesn’t matter if they are a student, they must be 16 years or younger.

That age group didn’t fall into the child or adult category meaning they get no money. I have a 19yo too.

We don’t qualify for the stimulus under 2018 bit filed 2019 and rcvd our refund yesterday. Status says “cannot determine eligibility”. ?

Hello,

I ‘m supposed to receive the full amount, but I only got $210 I’m not sure what it went wrong.

anyone had the same issue?

I’ve put in the exact information needed when I filed 2019. It’s saying my information did not match their record. Anyone have this problem? Is it because the system is messing up?

The same thing happened when I did it, it said I exceeded the amount of tries for today, to try again in 24hrs.

Hi, we received the payments, but we were counted as 4 while we’re 5 members! One of my daughters wasn’t counted. Their ages are 13,9, and 4. What should I do in this case? Thank you!!

If you don’t absolutely need that money right now, it might be wise to sit tight and see if the system corrects itself.

Also, you will be able to correct it on next year’s taxes. I know that’s not the ideal situation, if you need the money now.

i am having the same issues most of you all are having. My stimulus $ is being sent to an account that i have no idea what it is. If they were to use my 2018or 2019 DD information there would be no issues because i have those cards. i have no idea which account they sent my money to. i believe some of us are being scammed. Maybe whoever filed our taxes changed out acct information to be sent to their personal accounts. This is a perfect time for people to scam us out of our stimulus money. Everything is complete madness. If anybody has any answers on how to change DD info on the website please let me know!!

What do you do if your direct deposit account number shows the last four of your social security number, for the payment? Like it’s not showing my bank account number just the last four of my social. What does that means???? someone help me!!!!

My friend’s status was showing the same thing – the last four of her SSN instead of bank account – and she had NO deposit this morning. But, the money was deposited into her account shortly after lunch today. So – perhaps just a little computer hiccup. Keep watching for it to clear.

I got the message “we can not determine your eligibility “ what does it mean ? I’ve read through the list and I do qualify.

same thing happened to me and my husband they deposited it into a closed account can’t get a hold of anyone we called bank they said it was rejected and they should mail us a check so normally it takes a couple of weeks after initial rejection so it should be out the same time the other checks are mailed hopefully I’m still holding out hope that since so many of us have been rejected they will let us update online

I didn’t enter the 3 zeros before my bank account number. Do you think that matters? If so, how would I change that now?

What will happen if they deposited your check into a old account and it’s scheduled to be issued today? But it’s not a bank account it’s cash app? Idk why they let me put my new card info in if they were gonna use an old account anyway smh

What happens if the IRS deposits your check into an old bank account that you no longer have