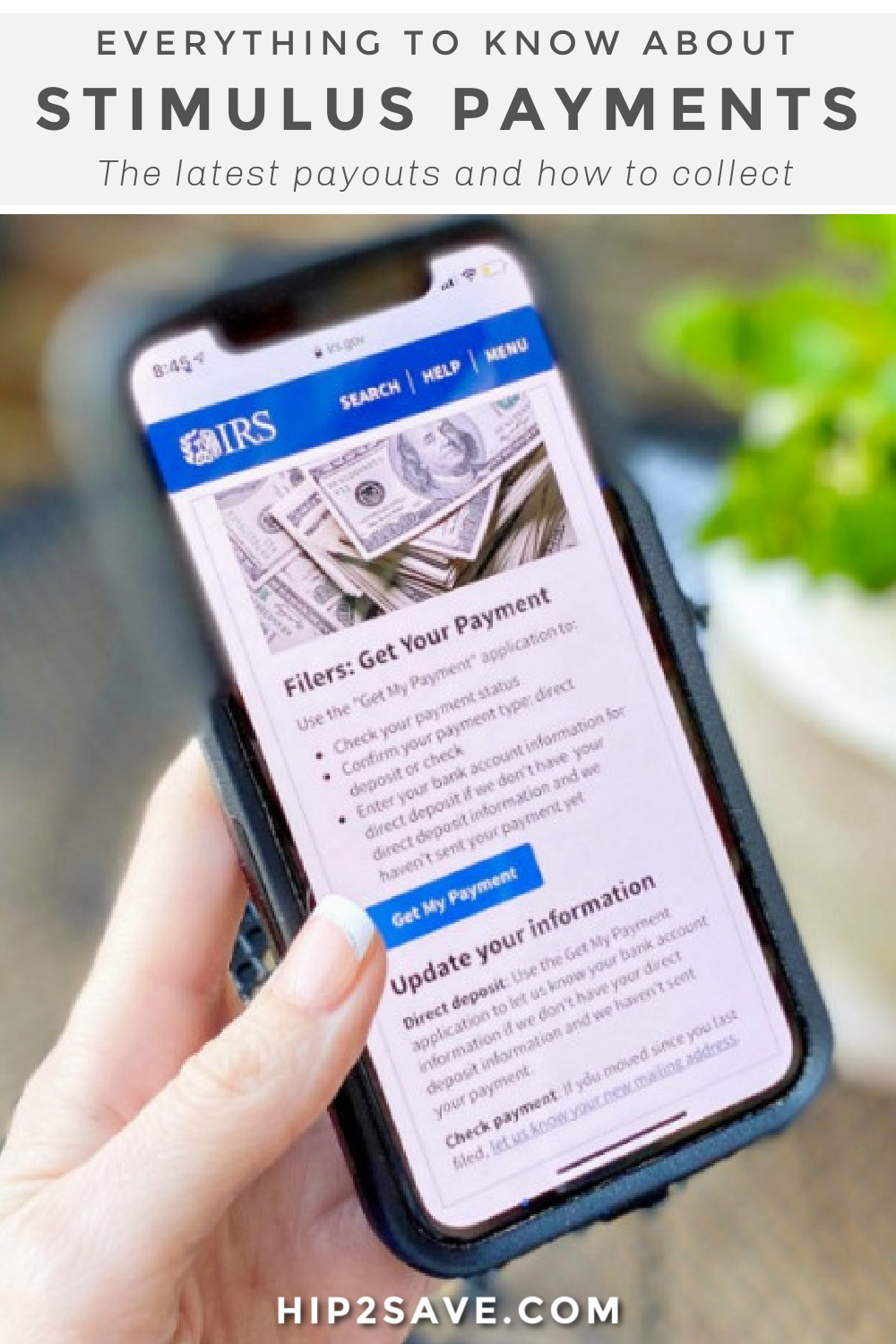

Several States Are Sending Out A Stimulus Check in 2022 (Are You Eligible?)

A state stimulus check might be headed your way in 2022.

Some states are providing economic relief via tax rebates.

Though the federal government probably won’t send stimulus checks in 2022, you might be receiving some help from your state. In the latest attempt to combat inflation and stave off a recession, well over a dozen states have decided to send income tax rebate checks to their residents. Most of these refunds are for small amounts (so don’t get too excited) but we do have the scoop on who qualifies and when to expect a payment!

Find your state below and see if you qualify for a stimulus payment:

California

Who qualifies:

- Single taxpayers who make less than $75,000 annually or couples who filed jointly that make less than $150,000 annually will receive $350 per taxpayer and an additional $350 if there are dependents.

- Single taxpayers who make $75,000 – $125,000 annually or couples who make $150,000 – $250,000 can expect $250 per taxpayer and an additional $250 if there are dependents.

- Single taxpayers who make $125,000 – $150,000 annually or couples who make $250,000 to $500,000 annually will receive $200 per taxpayer and an additional $200 if there are dependents.

When: First payments will go out as soon as October in the form of a direct deposit or debit card.

Colorado

Who qualifies:

- State residents who filed their 2021 returns by June 30 qualify.

- Individual filers will receive $750 and joint filers will receive $1500.

When: If filed on time, expect a check by September 30, 2022. Those who filed an extension will see a check by Jan 31, 2023.

Delaware

Who qualifies:

- State residents who filed their 2020 and 2021 tax returns qualify and can expect $300 per adult.

When: Checks will be sent out from May 2022 through the end of Summer 2022. Adults who did not file timely may also receive a check after October 17, 2022.

Georgia

Who qualifies:

- Full-time state residents who filed their 2020 and 2021 tax returns timely. If you filed an extension, you have until October 17, 2022. Part-time residents will receive a proportional refund.

- Single taxpayers will receive $250, heads of household will receive $375, and married couples filing jointly will receive $500 together.

When: Payments began going out in May 2022.

Hawaii

Who qualifies:

- Single taxpayers and heads of households making under $100,000 will receive a $300 return.

- Married taxpayers filing jointly and surviving spouses who make under $200,000 will also receive a $300 return.

- Individuals who make above $100,00 and couples who make above $200,000 will receive a payment of $100.

When: Payments will come via direct deposit or paper check beginning at the end of August 2022.

Idaho

Who qualifies:

- Full-time residents who file their 2020 and 2021 tax returns by December 31, 2022, are eligible for a payment of $75.

When: Payments started in March 2022 and were sent out via direct deposit or paper check. You can track your rebate payment on Idaho’s State Tax Commission website.

Illinois

Who qualifies:

- Individuals who earned less than $200,000 in 2021 (and were full-time residents) will receive a $50 income tax rebate.

- Couples filing jointly who earned less than 400,000 in 2021 will receive, together, a $100 tax rebate.

- Those with dependents can collect $100 per dependent with a maximum of up to 3 dependents.

- Illinois residents may also qualify for a property tax rebate or other economic relief under the Family Relief Plan.

When: Payments begin starting September 12th, 2022, and will be sent in the same method that your original tax refund was sent.

Indiana

Who qualifies:

- All state residents that filed their 2020 taxes before January 3, 2022, will receive a $125 taxpayer refund.

When: Payments should be received by September 1, 2022, and will come in the form of a direct deposit or check.

Maine

Who qualifies:

- Full-time Maine residents who filed 2021 tax returns (and are not listed as dependent on anyone else’s return) qualify for a payment if they file by October 31, 2022.

- Single taxpayers who make less than $100,000 qualify and will receive a payment of $850.

- Heads of households who make less than $150,000 qualify and will receive a payment of $850.

- Couples filing jointly who make less than $200,000 qualify and will receive a single payment of $1,700.

When: Payments started in June 2022 for those who filed timely.

Massachusetts:

Who qualifies:

- If relief is approved, individual taxpayers who made more than $38,000 but less than $100,000 in 2021 will qualify for a $250 payment.

- If relief is approved, couples who filed jointly and made no more than $150,000 in 2021 will qualify for a $500 payment.

When: If implemented, your stimulus check will be issued before September 30, 2022.

Massachusetts previously provided relief for eligible low-income workers. If you had a household income at or less than 300% of the federal poverty level and did not collect unemployment, you should have received a stimulus payment of $500 earlier this spring.

Minnesota

Who qualifies:

- Frontline workers who were employed at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021. Review the eligibility guidelines and apply for the payment before July 22nd, 2022.

- Frontline workers with direct COVID-19 patient contact qualify if they made less than $175,000 or $350,000 if filing jointly.

- Frontline workers without direct COVID-19 patient contact qualify if they made less than $85,000 or $185,000 if filing jointly.

When: Payments are anticipated to be sent in Fall 2022.

Gov. Tim Walz has also proposed an income tax rebate that is yet to be approved. His proposal is for a $1,000 relief for individual taxpayers making less than $165,000 and a $2,000 relief for joint filers making less than $275,000.

New Jersey

Who qualifies:

- New Jersey residents qualify if they filed the NJ-1040 in 2020 and have at least one dependent.

- Individual taxpayers who made less than $75,000 are eligible.

- Surviving spouses, heads of households, and couples filing jointly who made less than $150,000 qualify.

When: Checks began being mailed on July 2nd, 2022. New Jersey residents might also qualify for property tax relief which will be a separate payment.

New Mexico

Who qualifies:

- Individuals filing separately qualify for a $250 rebate if they made less than $75,000 in 2021.

- Married couples filing jointly, heads of households, and surviving spouses who made less than $150,000 in 2021 are eligible for a $500 tax rebate.

When: Payments for relief above begin in July 2022. New Mexico also offered two other separate stimulus checks. One was mailed in June 2022 and another will be sent in August 2022.

New York

Instead of income tax relief, New York has issued property tax relief for homeowners.

Who qualifies:

- Those who qualified for a 2022 School Tax Relief (STAR) credit or exemption are eligible for up to $1,050 provided their 2020 income was less than $250,000 and their school tax liability for 2022-2023 is less than their 2022 STAR credit.

When: If you qualified, your stimulus check was sent out starting in June 2022.

Pennsylvania

Like New York, Pennsylvania has issued property tax relief for homeowners.

Who qualifies:

- Homeowners who applied to the MyPath program and fit the eligibility requirements listed below.

- Homeowners are eligible for a maximum rebate of $650 if they make less than $35,000 (or are a renter who makes less than $15,000) and are seniors above the age of 65, have a disability and are at least 18 years old, or are a surviving spouse age 50 and above.

- Seniors in need may qualify for additional relief.

When: Check the status of your rebate using the “Where’s My Rebate?” tool.

South Carolina

Who qualifies:

- Any state resident who paid taxes this year is eligible for an income tax refund.

- Those that paid $800 or less will receive a full refund.

When: Payments are expected to be sent in late November and December.

Virginia:

Who qualifies:

- Only taxpayers with a tax liability last year are eligible.

- Individuals filers will receive $250 and those who filed jointly will receive $500.

When: Payments are expected to be sent via direct deposit or stimulus check starting in late September 2022.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

I always receive a check from my tax preparation place. So, my bank account info is not on file, it’s theirs. It says it was deposited today. But, of course it isn’t my bank acct that is showing. Anyone else in a similar situation. Trying to figure out how to go about receiving it.

It says my was deposited today to my account and there is nothing in my account. Not sure why

Same situation

Same with yours.. still nothing today

Same situation. Taxes were done on turbo tax

Check to make sure the account #### are matching. It might have been sent to a different old account like mine did.

Mine was sent to the bank on the 15th. Still nothing

Did your payment show up in your account yet? I’m in the same situation.

Did your payment show up in your account yet? Mine says it was deposited yesterday and I’ve seen nothing.

Me to!

Same situation with me. If anyone can advise please.

I am having the same issue. Mine says scheduled for deposit on April 30th 2020 and today is May2nd 2020 and still nothing pending for deposit in my bank account. I dont know what to do ?

Mine says the same.

Did anybody get theirs?

Same situation!

Most likely it was deposited with the person who does your taxes.

Can I use my daughter’s bank account to receive my stimulus check faster?

I saw news today about people getting less money from tax preparation places. They taking some percentage or commissions.

I received less the $1200, you mean Turbo Tax got $300??!!

That’s not right at all. TurboTax should have no claim on stimulus money.

We are in the same boat! I wish the IRS would do a better job about relaying this information to everyone. If only the site would allow us to put in our banking info! Thanks for the info!!!

It happened to me as well..now it’s saying it’s gonna be mailed but yet won’t let me put in my account info

I updated my bank account information but it still says I’m getting a check mailed out but I no longer live at that address

Same with me I changed my address last month and im jus hoping I get my check where I’m at instead

I received my check in the mail today.

My son received his paper check also but when he went to cash it they said they were unable to do so. They tried twice in WalMart and he did not receive his money. Have you heard anything like that happening?

Mine was there. Yay! First thing I did was buy some groceries and then donate to a rescue group I work with. Then I treated myself to a local restaurant delivery for lunch. Going to save the rest! Thanks!

I filed last year by mail, not electronically. But when I go on the site is says it cannot determine my eligibility (I am 100%). Has this happened to anyone else? I don’t owe the irs anything. Current on all returns.

I’m getting this message too, and so is my fiancé. We are both eligible. Apparently a lot of eligible people are getting this message. It’s unclear why at this point, but I wouldn’t take it to mean that you aren’t getting a payment.

Thank you for chiming in Tracy 🙂

My is showing it was deposited but my account number is showing the last 4 digits of my social and that’s not my account number ?

Same thing happened to me , and seems to have happened to a lot of people. So how does that get corrected? Or do we just lose out on our money because of all the red tape it’s going to take to even get it ?

So they send my 1200 Dallas to a account I don’t even recognized saying its in my account but up to this day I can’t see the 1200 IRS.gov not to correct it I need to spend money to pay my bills.

No way! Same name spelling😱😱😱

That’s happen to me too show my last 4 social

Same here. Does anybody know why and what to expect?

Mines saying that too. What does that mean

Mine to still say today deposited april 15 and my last four of my social the account I use for my 2018 was from empire tax and I still dont see no money and with my plant closed for this pandemic could be helpful got 3kids and a wife who needs her meds that we cant afford to fill if anyone knows what to do please let me know

Same thing here also. At first my correct last four of my account # and today it’s showing last of my SS#. What is going on with this ?

Any updates on your payment? It shows the last 4 numbers of my SSN under my bank information as well. Did any receive their payment?

You find out why?

I got this message too…

I too got this message and my family is certainly eligible. I received my 2019 tax refund on last Friday so perhaps others were processed before mine. I hope to see the status change soon enough. Does anyone know when the IRS updates their information? I read somewhere that they update it once a day so wondered if it was in am or pm is all.

According to their website, it is updated overnight.

The same thing is happening to me I know I absolutely am eligible but it keeps telling me if can not verify my information

Yes the site also told me that they cannot determine my eligibility for payment and I file 2018 and 2019. Both went direct deposit and I am eligible.

I did get the same response that they cannot determine my eligibility until 23rd April then on 24th April, message was updated to you are eligible and asked me to enter my bank info. So I think it takes time.

Is there any contact information to ask question about refund amount discrepancy?plz let me know .TIA.

I also am wondering what I need to do as mine was short one child. I already filed this year and should have gotten two children but only one was counted.

I think they are shorting everyone. I have 4 kids but only got money for 3. I’m not complaining, happy for what I got but it seems like most people didn’t get as much as they thought. Idk.

Is one of your children 16 or 17 ?

I don’t remember where I read but it said that you are eligible to get money for 3 kids only.

hello, i am in same situation i have 2 kids and niether of my kids got a check just mine, dont no what too do either.

I got my deposit today and have 3 children and did not receive any for my children. Did all of the money deposit at the same time? whom did you contact?

This is from an article from Yahoo.

“When will the stimulus check arrive? It depends.

Treasury Secretary Steven Mnuchin said at a White House briefing on April 2, that those Americans who have signed up for direct deposit will receive their payment within two weeks.

“Social Security, you’ll get it very quickly after that,” Mnuchin said. “If we don’t have your information, you’ll have a simple web portal, you’ll upload it. If we don’t have that, we’ll send you checks in the mail.

Americans with the lowest income will get mailed checks first, according to reporting by the Washington Post. Here’s the timetable for the first checks, per IRS documents seen by the Post:

Taxpayers with income up to $10,000: April 24

Taxpayers with income up to $20,000: May 1

Taxpayers with income up to $40,000: May 15

The rest of the checks will be issued by gradually increasing income increments each week. Households earning $198,000 who file jointly will get their reduced checks on Sept. 4. The last group of checks will be sent on Sept. 11 to those who didn’t have tax information on file and had to apply for checks, according to the Washington Post.

Do you have to pay back the stimulus check?

No. The stimulus payment is actually a refundable credit against your 2020 tax liability, according to Kyle Pomerleau of the American Enterprise, and is paid out as an advanced refund. That means you don’t have to wait to file your 2020 taxes to get the money.

It also doesn’t reduce any refund you would otherwise receive, Watson said.

In fact, if you don’t qualify for the stimulus check now based on your 2018 or 2019 tax returns, you may be able to qualify to take the tax credit next year when you file your 2020 taxes if your income meets the thresholds.”

I also wanted to add myself. Information about the Get My Payment tool may have been misunderstood or misreported.

You can add your Direct Deposit information if you have never provided it to IRS. However you can’t use it to update info. already on file with the IRS. I read that the IRS is not allowing that due to the possibility of fraud.

Hopefully though as payments are kicked back to IRS because of closed accounts, and they become aware of issues due to calls and emails, they will change guidelines and allow updating on the tool.

Due to calls and emails? There is no email address to be found. And there phone number is an automated message that basically says we can’t help you due to understaffing.

Thank you for the information

SSI Recipient Update!!!!!

I just saw this about payments now being sent automatically to SSI recipients :

https://www.irs.gov/newsroom/supplemental-security-income-recipients-will-receive-automatic-economic-impact-payments-step-follows-work-between-treasury-irs-social-security-administration

However…in order to receive the $500 per qualifying child….seems “the tool” will have to be used ASAP.

Check out the info below:

For those who receive Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI and have a qualifying child, they can quickly register by visiting special tool available only on IRS.gov and provide their information in the Non-Filers section. By quickly taking steps to enter information on the IRS website about them and their qualifying children, they can receive the $500 per dependent child payment in addition to their $1,200 individual payment. If beneficiaries in these groups do not provide their information to the IRS soon, they will have to wait until later to receive their $500 per qualifying child.

The Treasury Department, not the Social Security Administration, will make these automatic payments to SSI recipients. Recipients will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as they would normally receive their SSI benefits.

For those with dependents who use Direct Express debit cards, additional information will be available soon regarding the steps to take on the IRS web site when claiming children under 17.

Thank you so much for that information, I thought I was going nuts because it says access denied on the Irs web site get my payment. Thank you once again your information is very helpful.

Where do you see this on their website? I can’t locate this information. Thanks for the help!

At the link I posted above…. scan down the page and look for the highlighted ” For benefit recipients with dependents, extra step needed to claim $500 for children”. It’s in that area.

Can someone pleaseeee help me and give me the link as where I should give IRS my bank account info? I paid tax to IRS for the past two years never had direct deposit . I logged in to my account couldn’t find the link to give them My bank account info. Thank you so much

Is this it: https://www.irs.gov/coronavirus/economic-impact-payments

We had to pay in 2018 as well. The IRS site states that those who have had to pay taxes will receive their stimulus payment by check. They will start issuing them May 1 for the lowest incomes starting at $10,000 and going up in $10,000 income increments each week. Therefore if you are in the $60k to $90k income bracket it will be sometime in June and those closer to $100k and up will be July and August.

Got ours today! Paid off 3 credit accounts and bought a new washer and dryer. Boom…gone. Lol

But it feels good, I’m sure lol.

we got paid off a medical bill and bought a fridge. BOOM GONE but how nice to have a fridge coming that won’t free every piece of produce

Thank you Hip2Save for this post. Year after year you’ve saved me so much money. And this year as I’m almost divorced you saved me even more. My husband and I filed our taxes jointly early this year for the last time. I didn’t think we were going to get the stimulus check because my husband makes good money in his business. However he’s been sneaky about things so I figured I would check if we were getting a stimulus check through the site you posted today. Boom! We did get a deposit yesterday. If it weren’t for this post I would’ve never thought to check that account and taking my half of the money. This was a nice surprise to a newly single woman making it through this tough time. Thanks again for all you do Hip2Save.

You’re SO very welcome, Bea! I’m so happy this was helpful. 💖🤗

Excuse me my bf was recently divorced and apparently his ex wife got their stimulus payment in her acct but refuses to give him any of the money ..he works hard for his money and deserves more than she does..what can I do about this..Ty please help

My husband and I are separeted and filed jointly, our stimulus was sent but don’t have access the account. What do I if he don’t give me my part of the money?

Deposits made to closed bank accounts will be rejected by the bank and a check will be issued to the address the IRS has on file for you

Ours was rejected because of closed account and just checked the “Get My Payment” tool & it say the payment is scheduled to be sent April 24th TO THE SAME CLOSED ACCOUNT! Nobody to call and the bank is NO HELP. Don’t know what to do. They used the account from 2018 taxes. We filed our 2019 taxes early April with the new Account like the IRS stated and they STILL SENT IT TO THE WRONG ACCOUNT…………TWICE!!

Same exact thing here, I was hoping to see that it was just going to be mailed since they obviously couldn’t update their system fast enough with new back account on 2019 return. So what? Wait another week and a half for it to get sent then rejected again? I’m honestly glad we are still working because there are so many struggling already with unemployment issues and now this.

Website says my payment was scheduled for the 15th. Just checked my account this morning. Still nothing.

Same here..says will be deposited the 15th and the last 4 digits are correct but still nothing. Its now Sunday the 19th.

Yes mine says it was deposited April 22nd and nothing in my account, not even any pending deposits.

Plus all my info is correct and I contacted my bank and they said nothing is showing in my account…I’m getting so nervous. Has anyone had any good outcome for this situation?

Yes me says the 29 of April to be deposited into my account, and nothing and still nothing this morning banks says nothing posted, wow

I received a letter from the White House saying my $1200. stimulus check was direct deposit in my checking account, but no bank or account number was printed on the paper, dated 4-15-20 signed by Donald Trump..?? Anyone else received one..??

same for me,,, my deposit says 22nd but not showing in my account

My mom and I share an account and I wanted to know will we both get a stimulus check because she is on social security only

each person has to file separately unless she is on your taxes as a dependant

We got ours. We did only get money for 3 of our 4 kids but that’s OK. I’m glad for what I got. Gonna put towards student loans.

$3900 seems to be more then enough, meant to be used to manage bills for the upcoming month or two. Including Unemployment Benefits of an extra $600 a week per adult plus regular benefits, should be way more then enough money for most.

so im a stay at home mom and havent filed taxes in 4 years nor been claimed on anothers….i have a 4 year old that hasnt been claimed since 2015 will i be getting anything?

if you go to the irs page that is linked in the post there’s a section that talks about people who don’t normally file taxes, there’s a link there that takes you to a page for you to fill out your information

Help here! We have not filed 2019 yet, we filed 2018 and owed taxes so the IRS doesn’t have our direct deposit information. I checked on the link and I get the message “payment status not available” has any others had this same issue.

Yep, I’m in the same boat. On top of that we bought a house last year and moved. So I can’t make any changes. I was also told by an IRS agent last week that no 2019 taxes will be processed. So even if you file now, it could be months before they process it and then in turn send or deposit checks.

We had to pay in 2018 as well. The IRS site states that those who have had to pay taxes will receive their stimulus payment by check. They will start issuing them May 1 for the lowest incomes starting at $10,000 and going up in $10,000 income increments each week. Therefore if you are in the $60k to $90k income bracket it will be sometime in June and those closer to $100k and up will be July and August.

When you owe state or federal taxes, they can, not only find you if you move, but make sure they garnish your paycheck. But every time a situation like this happens, they put in an antiquated system that doesn’t work for everyone. They could’ve easily had everyone register their accounts on IRS to make sure direct deposit information is correct and verify addresses before the 15th. But now they have money going to old bank accounts and unless you file your 2019 now ( of which they are not processing) you could have checks that are going to old addresses, which is my situation. And many of us are getting this catch all “Payment Status Not available” message that doesn’t give you any information as to how you could correct the information you are putting in. So as of now, many people can’t change their direct deposit information and can’t change addresses unless you file your 2019 taxes.

My same exact scenario Yoli.

The Washington post put out a story today about those who received the wrong amount on their stimulus check. They are working on it.

Hello,

I filed my 2018 taxes on time but not my 2019 yet. My income was negative actually in 2018 from my business. I received the message that they cannot determine my eligibilty. Why would that be?

I received my $1200 yesterday deposited into my credit union acct.

We have to pay every year. I used the Get my payment link to enter our banking info as it stated but it tells me that there is no info about our eligibility? Can anyone provide any assistance? TY in advance

We had to pay in 2018 as well. The IRS site states that those who have had to pay taxes will receive their stimulus payment by check. They will start issuing them May 1 for the lowest incomes starting at $10,000 and going up in $10,000 income increments each week. Therefore if you are in the $60k to $90k income bracket it will be sometime in June and those closer to $100k and up will be July and August.

Thank you 😊

I heard on the news that if you had to pay in then on Friday you could add your bank account information to get it direct deposited instead of waiting for a check to be mailed.

Thank you 😊

We had to pay in 2018 as well. The IRS site states that those who have had to pay taxes will receive their stimulus payment by check. They will start issuing them May 1 for the lowest incomes starting at $10,000 and going up in $10,000 income increments each week. Therefore if you are in the $60k to $90k income bracket it will be sometime in June and those closer to $100k and up will be July and August.

Thank you 😊

Oh my goodness! Did you really copy and paste your same comment multiple times?

Who’s trolling? You?

No way! Same name spelling😱😱😱

Did you try entering $0?

Is there any help line where we can ask them who is eligible for this refund??

I was very surprised to find out today that the $3900 was direct deposited into our account so quickly yesterday. Going to hold onto the $ for as long as possible as we are sure what could possibly happen in the future. Good luck everyone and I hope you all see some extra $ very soon!

I have not done my 2019 tax return and had a new child in 2019. We received our stimulus check but it did not include our child. Does anyone know if that can be amended later?

You will get the $500 when you do your 2020 taxes

Still getting the same “Payment Status Not Available” message, 4/17/2020 and there is so much wrong information online. So I tried to call even if though it said you can’t. I don’t know how but I got in. Here’s what I found out. We filed in 2018 and owed money. We should be able to get in and put in our direct deposit information but the system refuses to let people who owed in 2018. They don’t know why, so they will mail you your check , if you are getting one at all, they cannot confirm that over the phone at all. They won’t even start mailing checks until May 1st. Our address is incorrect on our 2018 taxes also. We bought a house mid year last year. So even if they mail a check ( of which the system doesn’t confirm) it will go to the wrong address. Which is absolutely ridiculous because we currently get our IRS pay stubs and notices to our new address with no problems. I was told that it doesn’t matter, they are only looking at tax forms, not anything you have on file with the actual IRS department. Another big problem they aren’t telling everyone. They are informing people to file their 2019 taxes fast in order to get the stimulus. Well if you haven’t filed yet then forget it. They aren’t processing any individual tax forms at this time until further notice. So if you are depending on your 2019 to get processed in order to get the stimulus checks then you will be waiting a LONG time. They are only processing business tax returns at the time. This is pure BS and completely unorganized. They did not think this thing through at all.

Sooooo… I thought they were going to use 2018 tax info if you haven’t filed for 2019 to see if you are eligible?

I have updated my direct deposit information on the irs website and was wondering if anyone knows how long it will take to get my payment deposited?

Allow at least 48 hours for it to be processed. And because the Get My Payment site was so busy may be 72 hours. Also something to consider. Those who received their payments on April 15, many reported that the payment has been pending since April 10th. So even if it lands in your bank or CU it might be pending for a bit before it posts.

Have the younger people received their stimulus checks via direct deposit yet? My two boys are 19 and 22, both live on their own, filed taxes the last 2 yrs on their own, received federal refunds (thru direct deposit) the last 2 yrs with no issue. 2019 tax returns completed in early February 2020. Current bank info on both returns. Yet, neither have received their stimulus checks thru direct deposit. Anyone else in the same boat?

Any help at all?? Anyone?? 🙁

My nephew is 23. He and his girlfriend both got their checks direct deposited into their accounts already. I’m sure your boys’ checks will come soon. We are in Az.

Thank you Dreylawn. We are on the West Coast as well, hope it shows up for them the first of the week. Can’t understand the delay tho.

My son is 20, he filed for the first time this year, I actually did his income tax. His tax refund came in the mail already for 2019. I uploaded his bank info on the Get My Payment IRS site and two days later, it says that his check will be in the mail next week. Before I uploaded his bank account, it was saying cannot determine eligibility, I put his account number, now it’s being mailed…very confused. I’m happy as long as he gets it. As for me, I haven’t gotten mine, it keeps saying cannot determine eligibility…very frustrated.

Sara, your boys can still file their own return and can also be claimed as dependents by someone else. Do you know if you claimed them as dependents on your return? If you did, they won’t receive a stimulus check. And you won’t get any money for them bc they are older than 16. I have no idea why the government did it this way, but it hinges on dependent status.

Here is part of this article. It is long, but I thought this part might be especially helpful.

Author: VERIFY, Jason Puckett (TEGNA), David Tregde, Terry Spry Jr.

Published:6:23 PM EDT April 16, 2020

“WHAT DOES ‘PAYMENT STATUS NOT AVAILABLE’ MEAN?

The IRS’s FAQ page lists four distinct possibilities that may be causing an error saying “payment status not available.”

You could get it because you’re not eligible for a payment. You could get it if you’re required to file a tax return but have not done so for 2018 or 2019.

It’s also possible you could get it because you’ve recently filed your return or provided information through their Non-Filers portal. If that’s the case, your payment status will be updated when processing is complete.

You could also get this error if you are a SSA or RRB Form 1099 recipient, SSI or VA benefit recipient. In this case, your information is not available in the app yet but the IRS is working with your agency to issue your payment.

It can also show up if the information you type doesn’t exactly match what’s on your tax return. Something as simple as capitalization that doesn’t match could mess it up.

The IRS says the payment data is updated once per day, so you can check your status later to see if there are new details on your information.”

Also in the live segment, the gentleman said he had to enter his street address in all caps for it to display his stimulus information.

Additional information I read that may help some:

If you have no income and do not collect SS you MUST file with the Non Filers tool to claim your stimulus. If you have no Direct Deposit info. or choose not to enter it, it will come by mail to the address you submit via the tool.

If you filed your 2019 taxes and had Direct Deposit for your TAX REFUND. But then had to close your account. Then your 2019 TAX REFUND was MAILED to you.

You CAN use the Get My Payment

tool to enter Direct Deposit info. if you have a NEW BANK or CU account now and want your stimulus direct deposited.

gentleman said he had to enter his street address in all caps for it to display his stimulus information. This didn’t make difference at all. I made 35,800 last year my wife 38,000 and we filled married but separate. By doing it this way 99,000 is the cap but as you can see we aren’t close to it. I am confused as what the issue is?

I have been trying to figure out what date me and everyone else with ssi direct express cards are going to get our stimulus checks direct deposited on our cards. All kinds of websites and what not keep saying no sure or April 15 and other dates? So the main question I ask is whar date will we people with Ssi direct deposit cards are going to have the stimulus payments on our cards? Please and thank you respond with a direct answer or at least a more accurate date.

I was reading this on cnbc website:

Who will get paid starting next week

Mailed paper checks will start going out April 20 for Americans who do not have their direct deposit information on file.

About 5 million checks are expected to be mailed per week. It could take up to 20 weeks — five months — for all of the checks to be sent.

The payments will be sent out in order of lowest to highest income, so Americans with the smallest incomes will receive their checks first.

Who’s next in late April, early May

In late April, money will be sent to Social Security beneficiaries who did not file tax returns in 2018 or 2019. That includes adult Social Security retirement, survivor and disability insurance beneficiaries who typically have their monthly payments put directly in their bank accounts. Almost 99% of beneficiaries receive their monthly payments through direct deposit, according to Congress.

Meanwhile, all adult SSI beneficiaries can expect their payments by early May. The money will be sent in the same way those individuals typically receive their benefits.

“Weekly direct deposits and paper checks will continue until all individuals receive their rebates,” the Congressional timeline states.

Can we use a family members bank account to receive our stimulus check if we don’t have our own bank account?

Some more people are reportiing PENDING stimulus deposits in their BANK or CREDIT UNION accounts. They are pending to be POSTED to their accounts Wed. 22.

Here’s a fun one. I filed as married filing separately for 2018. Stupidly mailed my married filing separately 2019 in early March, and now IRS is not processing paper returns. My (now ex )husband has filed neither 2018 or 2019. What are the odds I’ll get a stimulus check ?

Have you checked the status of your RETURN? You can DOWNLOAD the app irs2go from Google. You will enter you SS#, filing status, and refund amount. Statuses are Return Received, Refund Approved, and Refund Sent. This has nothing to do with Get My Payment online tool.

The get my payment tool says mine was deposited April 22nd, but it’s not showing anything in my account, there’s no pending transaction either. Do you think it could take a few days until it becomes pending in my account?

If you filed for 2018 they have your information.

This stimulus check fiasco is more garbage by the government. When you go to get my payment for the last week he keeps telling you that they don’t have any information basically they don’t know crap. But it’s funny I see people that are still working people that make triple the money I do they’ve already got their checks but people like me and my wife are both out of work I’ll have to go back to side work working on car she’s older than I am and gets a Social Security check so they have all of her information we haven’t gotten anything they setvthis up completely wrong it’s a joke

What I was talking about with people that really don’t need the money right now you know what they’re gonna do with your stainless check? One person I know is going to buy a golf cart so I can get around his property the other person’s going to go out and buy a TV in a video game system may I plan on paying some bills and buying groceries I think that’s the idea of it they should’ve went by income even if it took a couple weeks to do that see who Needs the money the most for the worst and set it up that way but leave it to our government to get things backwards

Just read this on the IRS site in the “recent news” tab on the left side of their page. Those in this category need to follow the directions they have posted by Wednesday, April 22 by noon Eastern Standard Time.

SSA, RRB recipients with eligible children need to act by Wednesday to quickly add money to their automatic Economic Impact Payment; IRS asks for help in the “Plus $500 Push”

It happened to me as well..now it’s saying it’s gonna be mailed but yet won’t let me put in my account info

I’m disabled my spouse files joint return but used his own personal checking account which I am not on… and yes the money has been deposited but as I figured he will NOT give me my stimulus money. There is no way to contact or any information on the IRS’s site regarding this type of complaint. Any help with this matter would sincerely be helpful!

You will not be able to do anything you are married. That is between you and your husband. The irs has nothing to do with it.

I’ve always filed my taxes with Turbo tax on time and this year was the first year owing money. I filed the first of April and the IRS pulled the money out of my checking account the next day. I received no stimulus money on April 15th. Went to the portal and it stated that it found no direct deposit information, so I entered it. I’ve been getting this same message on the portal ever since “You are eligible for the payment. Once we have your payment date, we will update this page.” Still no money!! So frustrated!!!

Exact same boat I’m in.

Same with me. I was able to put my bank info in and than it said it will be deposited to my account. Now I am locked out and haven’t been able to check in days! And nothing has been put in my account

If you look at your 1040 form, your checking account information is only entered if you are due a refund and choose to received the refund with an automatic deposit from IRS. However, if you owe money, there is no such checking account entered on the 1040 form. So other than sending your payment due by check, the other alternative is through your tax software or preparer when you provide your checking account information to them. So apparently when you owe money and pay with your checking account information, that payment is made with your tax software company or tax preparer as the middle man, and thus the IRS does not save that information. So it looks like those who owed money will be getting a check, rather than an automatic deposit.

me and my husband file jointly and get a check, we now have a bank account so i updated our info on the irs website but when i go back in to check the status his ssn shows the right dp info but when i use my ssn it says not the info for dp. any idea why? we do not file a 2019 tax but we did 2018, and got the refund on a hr block emerald card.

we got ours on the 15th, the whole amount. we are just going to sit on it and see how things go!

Us as well, we’ll save it for a rainier day. I’m a hs teacher and our district asked any of us that don’t need it to donate it to the community and our students. If my hubby wasn’t laid off in March, we’d probably would do it

I received my paper check today. I am a stay at home mom and we have always filed married filing separate due to my husband being in a repayment plan for back taxes. I was not required to file a return this year but filed one anyway a few weeks ago. I wasn’t really sure what to do because everything has been so unclear so I was happy to see that worked.

I filed taxes for 2018 and 2019 I owe nothing nor did I get a refund. The question on the site ask how much refund or do you owe. I had no where to reply of no refund and not owing. The site kept saying error because I had no where to answer the question. Why is this so confusing? I don’t know what to do at this point.

I have the same situation. I ended up clinking on ‘got a refund’ and then entered ‘0’ in the box of the amount. Hope that works for you, it did for me.

I am on SSDI since 2014 and do not file taxes and yet for some reason when I went to use the GET MY PAYMENT on April 23rd it recognized my SS# and asked me to enter my Direct Deposit Info into the system and when I did it said that the stimulus payment would be sent to the Bank acct I put in and just did not give a date as to when so I have to wait 24hrs to see if it updates it.

The system should have not been able to help me because I get the 1099 form from SSA and yet it seems like I was somehow lost to it all until I took this action.

I get the 1099 but everytime I go to the get my payment it says it don’t have my information

I entered my direct deposit information on get my payment the day it went live and the site still hasn’t given me a deposit date or just says it will update when a deposit date is available

Same situation for me as well. Other people I know have received the paper check on April 24. I should have never bothered with the banking info.

Check your status now. Mine say it will be deposited April 30th.

I am on SSI and have a direct Express card will my stimulus payment go on that card every time I call they say they don’t know anything

I keep getting access denied not allowed to use get my payment no mater who information I enter. Why it first told me it did not have enough info on me how is that possible I collect SSI every month 638.00 per month thats it. With my daughter she used Turbo tax and got the direct deposit and it said it was going to be mailed on the 24th and she has not got it yet . I go to track it and it tells me access denied why? What is a person to do It tells not to call so how are we going to get our payment?

My son received his paper check also but when he went to cash it they said they were unable to do so. They tried twice in WalMart and he did not receive his money. Have you heard anything like that happening?

My son received his paper check also but when he went to cash it they said they were unable to do so. They tried twice in WalMart and he did not receive his money. Have you heard anything like that happening?